Marshall School of Business Dean Geoffrey Garrett talks with Poets&Quants on the business of energy transition and other sustainability initiatives at the Southern California B-school. Courtesy photo

In the year 2024, you’d be hard-pressed to find a reputable business school that isn’t talking seriously about sustainability. From global supply chains, to battery production and storage, to delivering reliable power to emerging markets and developed countries, the fastest-growing job sector is colored green.

Governments must act boldly to confront the daunting challenges of the climate crisis — and so will business. And that, says Geoffrey Garrett, dean of University of Southern California’s Marshall School of Business, requires a generation of business leaders and workers who understand how climate and business intersect.

“We’re living in a world where it’s quite easy for politicians to set very ambitious goals for carbon neutrality and zero emissions for 2030, 2035, 2050,” Garrett tells Poets&Quants. “But we know that getting there is going to be really, really complicated. Government mandates aren’t going to be enough.

“That’s why energy transition just feels both really important, and something that business schools should do. Our instinct is that private sector innovation will be a core part of that story.”

THE MARSHALL SCHOOL’S BUSINESS OF SUSTAINABILITY

While sustainability is often used as a catch-all term for a broad swath of environmental, social, and economic issues, The Marshall School wants to be a thought leader in the energy space. Particularly in the transition to low-carbon and carbon-neutral power sources.

In October 2023, it announced its Business of Energy Transition Initiative (BET) to confront the challenges of reducing carbon emissions around the world. This fall, BET will host the first annual USC Marshall Energy Summit, convening business executives, policymakers, faculty experts and students to explore energy transition.

It is just one initiative in a portfolio dedicated to what Marshall calls its Business of Sustainability. In April 2022, during her State of the University speech, University of Southern California president Carol Folt outlined her “sustainability moonshot,” a vision to make USC a world sustainability leader. That includes a commitment to make the university carbon neutral by 2025.

A BROADER SUSTAINABILITY CURRICULUM

This fall, Marshall released a new strategic plan with sustainability being a key framework.

While sustainability is infused into many of its core courses, Marshall is also working to roll out a broader sustainability curriculum. This spring, it launched its first sustainability-focused course, “Sustainability, Business, and the Future of Capitalism,” exploring the relationship between business and the environment. Garrett is co-teaching the course with Professor Paul S. Adler and other Marshall faculty.

And, at the undergraduate level, the school is now recruiting students for its new Hayes Barnard Sustainability Fellowship. Students selected for the two-year program will take tailored sustainability-focused courses, engage with sustainability leaders, and complete a 15-week practicum.

Poets&Quants recently sat down with Geoffrey Garrett to talk about these and other sustainability efforts at USC Marshall. Our conversation has been edited for length and clarity.

For context, explain a bit about the history of sustainability efforts at Marshall.

There are enormous opportunities out there in the world for our students, and we want to empower them to take advantage of those opportunities. But at the same time, it’s clear that the responsibilities of business leaders are higher than they’ve ever been before. I like to think about our education as providing a balance between opportunity and responsibility.

If you go down just one level from that, the opportunity side is mostly about technology and being fluent with technology. But the responsibility side is really about leadership. I think about that as human leadership. Sustainability obviously fits both.

Ten years ago, a business school would have been an unusual place to have a sustainability initiative because most people thought business was part of the problem, not part of the solution. In the subsequent 10 years, I think that’s flipped. We know now that private sector innovation is going to be an enormous part of the story in meeting all the sustainability challenges that we have.

If you put those two things together, it seems to me that, today, it’s absolutely essential for a leading business school – and particularly a future-oriented business school – to have a serious business of sustainability initiative.

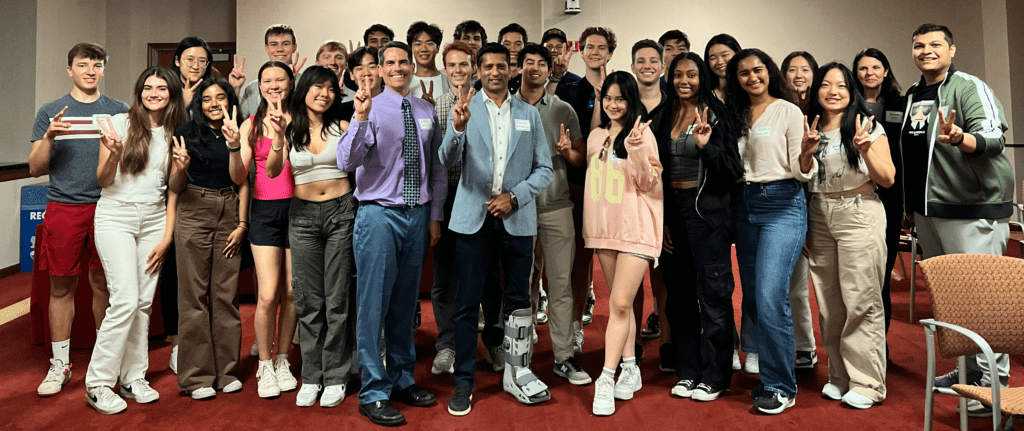

Darpan Kapadia, COO of LS Power, spoke to the USC Marshall Energy Business Student club, also pictured is Shon Hiatt, director of Marshall BET. Courtesy photo

I think I read that sustainability is a key part of your strategic plan.

We just launched in late fall a new strategic plan for the whole school, and one of the key frames for that is this opportunity/responsibility framework that I just talked about. We certainly framed sustainability as one of our most important priorities going forward. And, of course, it’s not only a priority for the business school, it’s a priority for all of USC. Our president, Carol Folt, has been a real champion, both on campus and in the world.

Speaking of the flip over the last decade or so, certainly most of the leading business schools are talking a lot about and launching sustainability initiatives. Some people have used the term ‘buzzword.’ Do you think sustainability concerns are here to stay, or is it the buzzy thing of the moment?

Absolutely we’re in it for the long term, not the short term.

I will tell you something that is happening below the surface at the moment at Marshall, but something, I think, is going to be really, really important going forward. Obviously, the three letters ESG have become political lightning rods in the last 6 to 12 months. Obviously, only the letter E (environment) pertains to sustainability.

Well, we have a big accounting group in the business school, the Leventhal School of Accounting, and we have some of the best accounting scholars in the world. You might be politely asking the question in your head: What does accounting have to do with sustainability? The answer is that ESG accounting is an enormous issue already for publicly traded companies.

I sit on the audit committee of a publicly traded company, and I know that at every audit committee meeting, we spend a chunk of time talking about ESG, cybersecurity, things we wouldn’t have in the past.

Marshall has two of the leading accounting scholars in the world, Richard Sloan and Patty Dechow, who are saying that ESG accounting can’t just be virtue signaling. There’s got to be some real value there which means you’ve got to come up with metrics and frameworks, you’ve got to be able to put dollar values on sustainability goals. Otherwise, it will be a bit ephemeral and buzzy. These two scholars want to write the book on ESG accounting, and I think that’ll have a multi-decade impact.

Another thing we are doing at Marshall is in October of last year we announced our Business of Energy Transition Initiative. We used the term “energy transition” with some thought because that’s what we’re talking about here. You know, governments can create net zero carbon emission targets, but somehow in society, we’ve got to get there. And, the only way to get there is through energy transition.

I think those two elements of what we’re doing in sustainability are both pretty distinctive, and they’re playing a long- term game. It’s not a short-term game.

Well let’s dive into the Business of Energy Transition Initiative a bit more. What are some of the concrete actions that you hope come out of it?

It’s quite easy for politicians to set very ambitious goals for carbon neutrality and zero emissions for 2030, 2035, 2050. But we know that, the next level down, getting there is going to be really, really complicated. Government mandates aren’t going to be enough.

Our instinct is that private sector innovation will be a core part of that story, and that it will be a transition. We will live in a world in which we’ll have some baseload electricity provided by oil and gas, but if you’ve got a wind farm and a solar farm and maybe a hydro farm, that’s going to help you, but then you need advanced battery technology to store that energy. That’s the transition story.

Think about electric vehicles. It’s easy to say that we’re going to get rid of the internal combustion engine, but how are we going to roll out the charging infrastructure to make that work? The government’s not going to do that. That’s going to be a business undertaking. Sure, there’ll be government rules. Sure, there’ll be government subsidies. But we know that most of the implementation is going to be in the private sector.

That’s why energy transition just feels both really important, and something that business schools should do.

So what does the business school role look like to you? Is that new degree specializations or certifications? Research? New courses?

Of course, all of the above. We want to be a real thought leader in the energy space, convening other thought leaders and developing our own work. We want to have lots of two way engagement with industry. We’ll have a big energy summit in the fall on that topic.

Then, of course, we’ll have specific classes on energy, but also we’re trying to roll out a broader sustainability curriculum where I think energy is the biggest piece of the whole story. It’s not the only piece, but it’s a big piece.

Can you tell me a little more about the curricular updates around sustainability?

Marshall, as you know, is a big complex school. We have 1,500 MBAs, we have 1,500 master’s students, we have 4,000 undergraduates. As I like to say, it’s a big, comprehensive business school.

We just launched this spring our first sustainability course. It has specialized master’s students in it, full time MBAs, executive MBAs, and interestingly to me, a lot of international students. I’m teaching in that class.

The class is called “Sustainability, Business, and the Future of Capitalism,” which we thought was a kind of sexy title, but it’s appropriate because this is the future of business. We’re doing it first at the graduate level and then at the undergraduate level.

Dean Garrett chats with clean tech entrepreneur Hayes Barnard who guest spoke at Marshall on March 7. Photo courtesy of GoodLeap

I think the thing that’s distinctive about the class is that we want it to be really, really, contemporary. It’s not business school case studies in the traditional sense, which are backward looking. We want to be contemporary and forward looking.

I’ll mention three sessions that I’m personally involved in. The person who runs the Port of Los Angeles – the largest port in the world – now has local, state, and federal sustainability mandates on how he’s going to run the port in the next five to 10 years. In the class, we’ll have a real time conversation about the opportunities and challenges of doing that.

Somebody that I’ve gotten to know very well, and whom I admire enormously, is the CEO of Deloitte. You think about Deloitte as a consulting and accounting firm, which they are, but the CEO Joe Ucuzoglu has made multibillion dollar commitments for sustainability. For our students, we can talk with Joe directly about what Deloitte is doing internally, but also what they’re seeing in all of the companies that they work with.

Just last week, I was talking to a fantastic entrepreneur out of Texas, Hayes Barnard, who did a lot of the financing for rooftop solar on people’s homes. The irony is that in Texas of all places, you have this leading company on solar. I was talking to Hayes about the business of solar power in the U.S. – do the subsidies work, not work, the best locations, very contemporary stuff.

But on the other side of his business now, Hayes has a not-for-profit that is using solar powered desalination technology in emerging markets. Water is the number one issue in poor countries, but desalination is really power intensive. So, he’s taking on the challenge now of: Can you have zero carbon desalination in the developing world?

Those are just three examples of what we are talking about in this class. This is not studying the textbook on what’s going on in sustainability. This is talking with the people who are doing it on the ground, which as you know, is always super motivating for business school students. They want to see the relevance immediately of what they’re doing. And in this case, I feel pretty good that we’re absolutely at the cutting edge of what is happening in the world of business today. We’re looking to the future rather than studying the history.

Have you had much opportunity as dean to get back into the classroom prior to this course? Why is it something you personally wanted to be a part of?

It’s a personal passion for me. I think you know that business school deans are fully employed. The only two times I’ve been able to get into the classroom at Marshall are on this topic of sustainability, because I think it’s so important, and on globalization and deglobalization, which I also think is very important.

And by the way, this is an area where there’s a complete intersection. The last sustainability lesson of the semester is called the “Geopolitics of Sustainability.” I’m going to talk about all the issues of Chinese domination of green supply chains, electric vehicles, battery technology, and how should the U.S. react to that? How should the European Union react to that?

Back to my theme of trying to be right on the cutting edge of where the world is going, I fully expect that the export of Chinese electric vehicles is going to be one of the biggest stories in the global economy for the next three to five years. In the U.S., we’re probably not going to have many Chinese vehicles because the tariffs are already high. But the Chinese carmakers are targeting the European Union, mostly with electric vehicles. BYD is a company that we’ll hear more and more about, and I suspect that’s going to be an enormous political issue in Europe. On the one hand, they want to be green and sustainable. On the other hand, they don’t want to buy this technology from China.

So those are my two passions, globalization and sustainability, and they come together in this case.

You mentioned that you’d like to bring this course to undergrad students eventually. Do you have a timeline in mind?

We’ll do a debrief after this semester, because this was a very ambitious class – bringing in so many high level guests, and it’s being taught by lots of our professors. But absolutely we’d like to offer it to undergraduate students as well.

One of my passions is to make the quality of undergraduate business education as good as MBA education. My feeling is that we can do most things at the graduate and the undergraduate level and take advantage of our scale and scope to do them better than at smaller, pure play MBA schools. We have a scale and scope that gives us the opportunity, I think, both to be broader and go deeper than most schools.

Graduate students outside USC Marshall School of Business. Courtesy photo

What has student feedback been so far?

The students are incredibly engaged. And as I said, we have a lot of international students, and their engagement in this class is really, really high. I’ll give you an example: We have great alumni in Indonesia, and Indonesia has been a massive coal, gas, and oil exporter for a long time. Right now, they’re trying to become a core part of the green supply chain because they’ve got some of the biggest nickel deposits in the world. But nickel mining is very dirty and energy intensive, and it costs a lot of money.

I knew this, but I didn’t expect the students to know it. When we were talking about battery technology, one of the students stuck up their hand and says, “Well, do you think Indonesia can become a battery superpower?” I wasn’t talking about Indonesia at the time, but that’s what the student wanted to talk about. Talk about crowd sourcing.

Another example: We have a few Indian students in the classroom and I’m sure you know that India is a really big emitter. There’s this question whether we should force India to reduce their emissions before they develop as opposed to the West which got 150 years before we had to do it? So now our Indian students have connected us with a very senior government bureaucrat in India who’s rolling out solar in Indian villages. I didn’t even know that there was solar in Indian villages. So I’m going to do a moderator conversation with that person. That was literally a whole new session of the class that came to us from a student.

You said that this was the first course focused solely on sustainability. Will more be coming?

That’s an interesting question, and I’m sure you’ve heard this dilemma before: We have dozens of classes that have sustainability elements, as you would expect because it touches everything. But my instinct, when I asked one of my senior colleagues to take the lead in developing this class, is you’ve got to have a flagship. Of course, you should have sustainability touching everything in your curriculum, but I hope we can have a flagship graduate and undergraduate class.

Marshall also recently announced The Hayes Barnard Sustainability Fellowship (HBSF). Tell me about that.

This is for undergraduates, and we’re thinking both about technical skills and about human leadership as the two elements of our education. This fellowship is going to have both.

Students will already be committed to sustainability and have quite a bit of knowledge, but we want to turn them into leaders. We’ll do that through a combination of experiential learning, internships, and leadership training all in the sustainability area.

This is a theme of business school: Much of the value of the education happens outside the classroom, but tuition pays for classes. So, if we’re going to do things like this which are really above and beyond, we need philanthropy to support it. In this case, it was actually Hayes Bernard’s business partner who wanted to honor him and gave us a really generous gift to create this program.

The program will start in the fall, and we’re just recruiting the students right now. The entry barrier is going to be really high because the interest in this among our students is enormously high. And of course, it’s not only students in the business school, it’s for all USC undergraduates who want to be involved.

When you talk to employers and business leaders, are they actively looking for sustainability skills, leadership, etc., in their recruits? And, with the often political backlash against DEI in hiring, are you hearing any of the same in the ESG and sustainability spaces?

I think about it in two ways: One is, in most companies, you need to be thinking about sustainability. To use a local USC example, Los Angeles is a big real estate town, and we have a big real estate program. Employers want to hire people in real estate, but they also know that energy efficiency is unbelievably important to the bottom line. So, if you’re gonna work commercial real estate, you’ve got to understand energy efficiency. Is that a sustainability job? I’m not sure. It’s a real estate job where sustainability is part of the business.

Obviously, when you get closer to consulting and finance, there are sustainability tracks now. Whether they’re contested or not is a different matter.

Joe Ucuzoglu, the Deloitte CEO, was telling me, for example, that the two biggest growth paths of Deloitte’s consulting business are sustainability and cybersecurity. That makes perfect sense to me. These are new challenges. So, if you go to work for Deloitte, is that a sustainability job? Again, I don’t know. But I know that sustainability is going to have a big impact both on what people do and what the services the firm provides.

What, in your opinion, is unique about Marshall’s sustainability efforts, compared to what other business schools are doing?

Given how important it is to our world, and how many young people are motivated to make a difference, it’s no surprise that business schools are becoming bigger and bigger players in sustainability.

I want to think about, as a matter of strategy: What can we do better and differently than other people? I think that our energy transition program is pretty unusual – unique is a high bar. The fact that we’ve got the leaders in ESG accounting, I think that’s great. As for curricular offerings, I hope our class is as good or better than others. But, you know, who’s got the best finance class? All business schools have them.

I would underscore the point about leadership and leadership happening outside the classroom. I do think the Hayes Barnard Fellowship model is a really good one, because it combines domain expertise in sustainability with a leadership training program and makes all of that experiential. That’s a nice combination.

I don’t want to say we’re doing things no one else is doing, but I think these are focused initiatives that are high impact. High impact on our students, and I hope high impact on the world.

Anything else you’d like to add, or that we should keep our eye on?

I suspect our energy conference in the fall is going to be a really big deal. Historically, those conferences would be in Houston, Texas, and they’d be with the oil and gas industry. I think ours will look very different from that, not only because we’re in California, but because we can focus on transition.

One of the philanthropic supporters of the Business of Energy Transition Initiative is somebody who’s done some of the biggest conventional energy deals in the world as a banker. I can’t tell you the person’s name as it’s a confidential, anonymous gift, but that person knows that you know that China and India are one, they know they have to move to sustainable power and, two, they want to become world leaders in that technology.

Again, for me, the two themes would be, let’s be cutting edge and look at where the world is going. And two, let’s make it real dialogue, a two-way dialogue between the university and the real world. That is, I think, what’s distinctive about our energy transition focus.

DON’T MISS: FREE DOWNLOADABLE GUIDE: SUSTAINABILITY & BUSINESS EDUCATION and RANKING: 2023’S TOP BUSINESS SCHOOLS FOR SUSTAINABILITY

Questions about this article? Email us or leave a comment below.